Ethereum is bleeding out, down 53% since February, as the market unravels around it. The scapegoat is the March Eric Trump crypto post.

Eric Trump’s ill-fated “buy ETH now” pitch from earlier in 2025 has aged like milk. Scorn from traders and skeptics alike, even Peter Schiff, is pouring in as the market burns.

Why The Eric Trump Crypto Post Faces Backlash

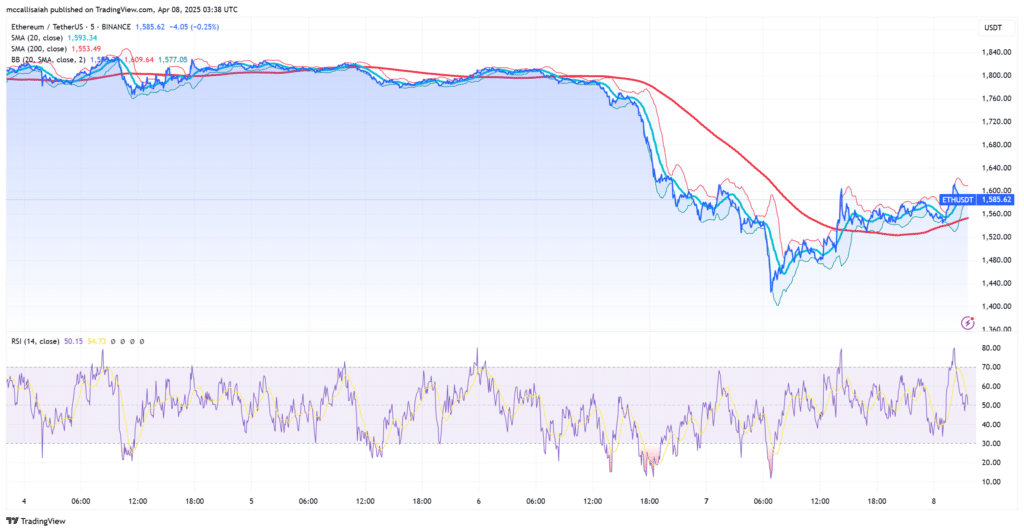

Ethereum has plunged 13.8% over the last week, breaking the $1,500 barrier and triggering a broader altcoin meltdown. Once hyped as the clear L1 pick for institutions, the token has been in free fall since Eric Trump’s ill-fated “add $ETH” mantra at $3,400. Now it’s sitting at $1,550, dragging investors with it.

Hovering over this disaster is the storm of Trump’s trade policies.

JUST IN: Stock market bounces back while more than 50 countries, including Japan and the EU, have contacted the United States to negotiate deals on tariffs.

The Trump effect at work. pic.twitter.com/lXzqEepZtH

– Libs of Tultok (@libsoftiktok) April 7, 2025

On February 3, 2025, Eric Trump took to Twitter (now X) to share his optimistic take on Ethereum, stating, “It’s great to add $ETH. You can thank me later.” Initially, the announcement gave ETH a brief 25% boost, but the rally quickly faded as broader economic fears mounted.

Critics have since scrutinized his advice, with some claiming it was tone-deaf at best and manipulative at worst. Further fueling skepticism, World Liberty Financial (WLFI), an investment firm managed by Eric Trump, sold $175 million worth of ETH shortly after his tweet.

Peter Schiff, a renowned gold enthusiast and frequent critic of the Trump family, mocked followers of Eric’s advice, remarking, “Yes, it’s best not to take any investment advice from the Trumps.”

Chris Bakke, a tech investor, drove the point home with a biting comment, “If you invested $100,000 in ETH at the time of this post, you’d have $46,782 and be divorced by now.”

The Impact of Tariff Fears on Crypto

Ethereum’s slide owes plenty to outside forces. Hours before Eric Trump dropped that ill-fated tweet, his father’s administration stirred economic unrest with tariff threats that sent markets scrambling. High-risk assets like crypto didn’t stand a chance in the chaos.

And it’s not the first time Trump-adjacent tokens have burned investors. The pump-and-dump spectacle of TRUMP and MELANIA coins lingers, leaving the crypto world suspicious of anything tied to the family name.

DISCOVER: The Best Utility Projects on Solana Crypto in April 2025

Lessons From the Eric Trump Crypto Post

Eric Trump’s Ethereum cheerleading is now a case study in overhyped investment calls. Political tides and internal shakeups can turn sentiment on a dime, and Ethereum’s nearly 70% plunge below its $4,878 peak proves just that.

The wreckage has left investors battered, hopes pinned to an elusive recovery. But the future of ETH hinges on how this tariff war plays out and if faith in decentralized tech returns.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

-

Ethereum is bleeding out, down 53% since February, as the market unravels around it. And the scapegoat is the Eric Trump crypto post from March.

-

Ethereum has plunged 13.8% over the last week, breaking the $1,500 barrier and triggering a broader altcoin meltdown.

-

Eric Trump’s Ethereum cheerleading is now a case study in overhyped investment calls.

The post Did Eric Trump Crypto Post Kill ETH Bullrun? ETH USD Tumbled Since Trump Tweet appeared first on 99Bitcoins.