| Key Points: – Zora Faces Criticism for allocating 65% of the token supply to insiders despite calling the token “for fun.” – Token offers no governance, profit-sharing, or clear utility for holders. – Industry experts warn the strategy may exploit legal gray areas and damage trust. – Launch on Base coincided with its peak activity, sparking speculation about Coinbase’s involvement. |

Zora faces criticism for calling its token “for fun” while assigning most of its supply to insiders, sparking backlash over transparency and intent.

Zora, a well-known Web3 NFT protocol, has reignited concerns over regulatory evasion and public trust, as major token holders remain insiders and legal classifications remain ambiguous. The controversy highlights ongoing tensions in crypto transparency efforts.

Zora Faces Criticism Over Token’s Purpose and Allocation

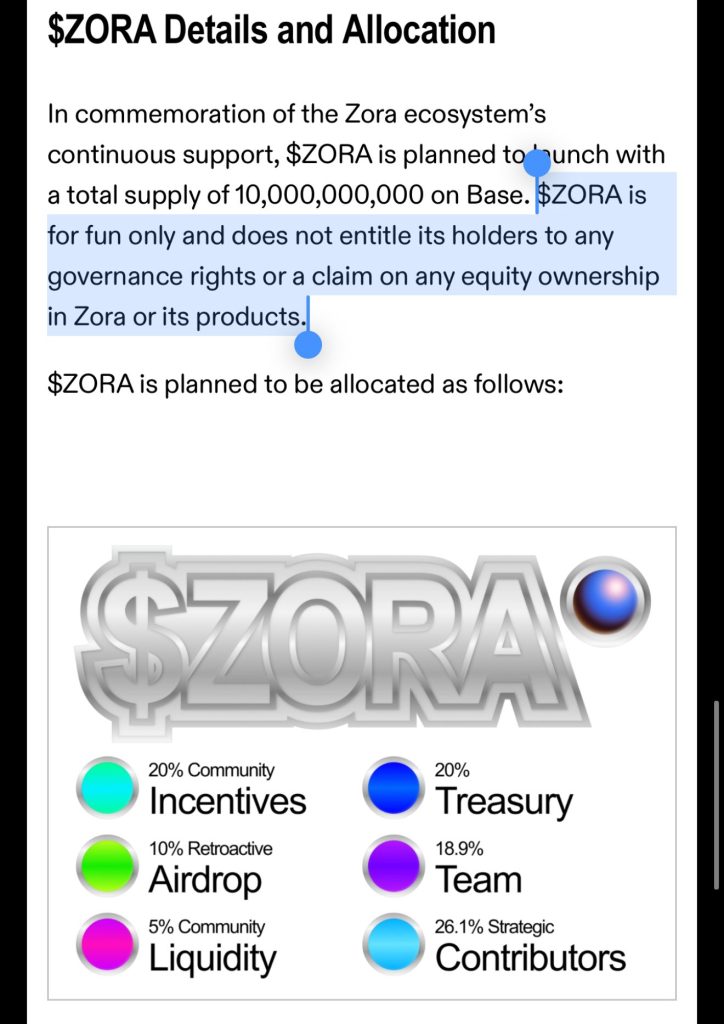

Zora’s recent announcement to launch a token described as “for fun only” has stirred significant controversy. The token, expected to go live on April 23 on Coinbase-backed Base, offers no governance, ownership, or revenue-sharing rights. Despite this, 65% of the total 10 billion supply will be allocated to insiders—18.9% to the team, 20% to the treasury, and 26.1% to early investors.

This inconsistency quickly drew community backlash. Influencer Karbon questioned why a token with “no value” would warrant such significant insider control. The term “for fun,” critics argue, may be a legal maneuver to avoid securities classification, but it risks sending a damaging message in a time when crypto seeks to build public trust.

Legal Shield or Market Gimmick?

The phrase “for fun only” might seem harmless, but many in the industry see it as a tactical shield against regulatory scrutiny. Karbon and blockchain sleuth ZachXBT speculated that Zora’s legal framing could be an attempt to sidestep classification as a security. However, they argue that releasing a token with no function, while concentrating power among insiders, sets a dangerous precedent.

ZachXBT emphasized that if Zora truly intended the token to be just “for fun,” it should’ve been fair launched—distributed openly without special access for the team or investors. “Either build something of value or launch fairly,” he said, calling the current model a credibility risk for an industry trying to rebuild trust.

Investor Concerns: Lack of Utility, Excessive Hype

Kevin Mills, head of research at Triton, joined the chorus of critics by stating that marketing a token with no clear purpose, then hyping it with insider allocations, sets up small investors for disappointment. He warned that this structure enables teams to generate pre-launch hype and inflate valuations while providing no tangible benefit to public participants.

Given Zora’s history of raising over $60 million at a $600 million valuation, the community questions whether the “fun” narrative is an authentic ethos or a smoke screen for insider enrichment.

Base Network Timing Sparks Coinbase Speculation

Zora’s token launch coincides with Base network activity surpassing Solana, raising eyebrows about potential alignment with Coinbase’s broader narrative. Social media users speculated that Coinbase might be indirectly leveraging its Base infrastructure to boost Zora’s visibility and token demand.

Some compared Zora’s $12.7 million token market cap to memecoin platform Pump.fun’s $3.1 billion, suggesting the token’s real appeal lies in narrative manipulation rather than fundamentals. As KOL Jesus Martinez sarcastically noted, “Base is for everyone” may have been a clever PR move for a token they backed early on.

Zora faces criticism not merely for launching a token but for how it chose to do so, masking insider-heavy allocations behind a “just for fun” label. In a market desperate for credibility and transparent tokenomics, such a strategy has left many wondering: Is this just poor optics, or deliberate misdirection? One thing is clear—the community is no longer amused by “fun” tokens when real capital and centralized control are involved.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |